Market Report: East Bay Real Estate Roundup

Market Report: East Bay Real Estate Roundup

Understanding the housing market is complicated. National headlines and statistics can make it seem like the market is doing poorly everywhere when, in fact, that's not the case locally. For example, many East Bay home sellers are thriving despite contrary national data. In this month's market report, we eyeball recent headlines through a Bay Area lens, examining February 2023 home sales, mortgage rates, the luxury market, and the best cities to buy a home in 2023 (hope you like fried chicken and peach cobbler). So, read on.

National housing market dips, but East Bay sellers still succeed

Remember what we said last month about interpreting doom-and-gloom housing market headlines? Choose your news carefully because the national picture has been very different – worse for sellers and better for buyers – than the local conditions we experience in the East Bay.

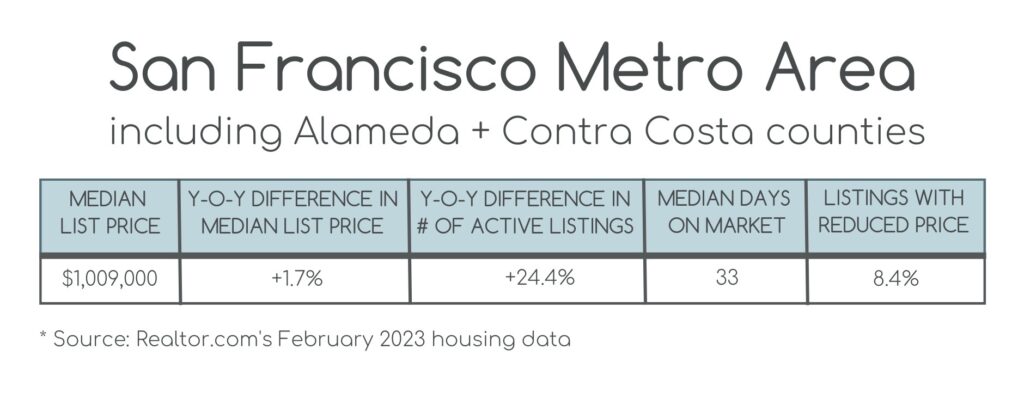

Here's the latest example from Realtor.com's February data:

National:

- The number of homes for sale in February 2023 increased 67.8% compared to last February.

- The median list price of homes for sale has increased 7.8% year-over-year.

- Homes spent 67 days on the market, 23 days longer than last February.

Local (San Francisco Metro Area):

- The number of homes for sale in February 2023 increased by only 24.4% compared to last February.

- The median list price of homes for sale has increased by 1.7% year-over-year.

- Homes spent 33 days on the market, 19 days longer than last February.

Million-dollar homes on the decline

As high mortgage rates, inflation, and job cuts cooled the housing market, the Bay Area, Seattle, and New York regions lost million-dollar homes faster than the rest of the country, according to Redfin’s latest Housing Value Index report.

The share of San Francisco homes worth $1 million or more fell from 86.3% in January 2022 to about 80% this January. Oakland, where 44.8% of homes are worth $1 million or more, saw a 5.2% drop in million-dollar homes.

Yet… Luxury real estate market showed surprising signs of a rebound

Go figure, there’s a contradictory report. According to numbers released by Compass, the San Francisco Bay Area luxury market showed signs of a rebound in February. There were 39 sales priced at or above $5 million, compared to 28 in January and 30 in December.

What’s up with mortgage rates? They're up, that's what.

The year started with happy news for homebuyers as mortgage rates dipped to about 6%. But in early March, the average rate on a 30-year fixed-rate mortgage climbed into the 7% range.

Nationally, analysts say this caused homebuyers to pull back once again, as evidenced by a 44% decline in mortgage applications.

What’s the effect on the East Bay market? So far, we don't see a huge impact caused by this month's interest rate fluctuation. With years of pent up demand for housing, the East Bay will remain a seller’s market as long as buyers outnumber homes for sale. And we don't see the supply/demand ratio changing significantly anytime soon.

Can't afford the Bay Area? NAR says head South in 2023

Are you selling your East Bay home but not sure where to move next? Where you can afford to move? According to a National Association of Realtors forecast, your best bet could be in the Southern states. NAR selected these the top 10 cities and metro regions, largely based on affordability:

1. Atlanta-Sandy Springs-Marietta, Georgia

Median: $371,200

Why consider it: Follow the jobs. Major companies have opened Atlanta offices, including Apple, Microsoft, and Visa in recent years. Other prominent companies with established or expanded headquarters include The Coca-Cola Company, Delta Air Lines, UPS, Home Depot, and AT&T.

2. Raleigh, North Carolina

Median: $460,500

Why consider it: Bay Area-ish with a much lower cost of living. There are three top-tier universities, three major medical centers, a rich cultural scene, and a low unemployment rate. Plus, you can be at the ocean in less than two hours and the mountains in less than three.

3. Dallas-Fort Worth-Arlington, Texas

Median: $390,100

Why consider it: Emerging tech hub with job growth. The region also leans toward being a buyers market, with the number of active home listings triple the national average, according to NAR. The area has world-class museums, performing arts venues, sports teams, and plenty of sunshine for outdoor recreational activities.

4. Fayetteville-Springdale-Rogers, Arkansas-Missouri

Median: $328,400

Why consider it: Home to three Fortune 500 companies — Walmart, Tyson, and J.B. Hunt Transport Services – providing jobs and driving economic growth. Other draws include renowned universities, including the University of Arkansas, and the area's natural beauty, with the Ozark Mountains and several state parks nearby.

5. Greenville-Anderson-Mauldin, South Carolina

Median: $335,400

Why consider it: Besides the low cost of living, this region is known for its natural beauty, with scenic parks and trails, lakes, and mountains all within easy reach.

6. Charleston-North Charleston, South Carolina

Median: $416,800

Why consider it: Southern charm steeped in history. The area is known for its beaches, cuisine, and cultural heritage. The economy is diverse, with a strong focus on manufacturing, healthcare, and tourism.

7. Huntsville, Alabama

Median: $327,500

Why consider it: Stretch your dollar further. Huntsville is a rapidly growing city that offers a blend of Southern charm and high-tech innovation. The city is home to NASA's Marshall Space Flight Center and the U.S. Army's Redstone Arsenal. Facebook and Google announced plans to expand their data centers in Huntsville.

8. Jacksonville, Florida

Median: $398,000

Why consider it: Bankrate placed this northern Florida city in the top 10 best metro areas for first-time buyers in 2023. Jacksonville boasts a low cost of living (84.2% cheaper than the Bay Area by some accounts), beaches, and the nation's largest urban park system in the nation.

Median: $342,700

Why consider it: San Antonio became a migration hotspot during the pandemic for Californians, thanks to the low cost of living, strong job market, and warm weather. San Antonio was ranked as the fastest-growing city in the nation between 2021 and 2022. It's a melting pot of cultures with a diverse population and large Hispanic community.

10. Knoxville, Tennessee

Median: $331,100

Why consider it: Better affordability and fast-growing job market. According to the NAR report, housing is about 10% more affordable than at the national level. Located in the foothills of the Great Smoky Mountains, the city boasts beautiful scenery and outdoor recreational opportunities. It's also home to the University of Tennessee, which provides a college town atmosphere.

See how YOUR city's real estate market performed in February:

The following graphs refer to detached single-family homes. Sources: Bay East Association of Realtors and Contra Costa Association of Realtors.

Don’t see your city of interest here? Get in touch, and we’ll dig up those numbers for you. 888-400-ABIO (2246) or [email protected].