How to Buy a House in the Bay Area in 2021 – Latest Sales Data Suggests a Frustrating Winter for Homebuyers

How to Buy a House in the Bay Area in 2021 – Latest Sales Data Suggests a Frustrating Winter for Homebuyers

Would it be too dramatic to compare the current real estate market to the Hunger Games?

Okay, a slight exaggeration. But we know many Bay Area homebuyers are feeling strained and drained by the intense competition for a limited supply of homes for sale. Hopeful buyers are wondering how the heck anyone wins a bidding war in this strange pandemic-era market.

We get it.

“This is one of the hardest times in real estate when we are helping clients write multiple offers and managing their multiple disappointments,” says Linnette Edwards, Abio Properties co-founder and associate broker.

We got you. Read on and we’ll share tips about how to buy a house in the Bay Area, specifically the East Bay. First, let’s set the scene.

>> BE FIRST: See the newest home listings here 🏠

February median sales prices rose year-over-year in the East Bay

If you follow our monthly market reports, you know that local real estate sales have been fast and furious here despite the pandemic. Our analysis of February data, the most recent available, shows the housing market stayed hot even during the cold of winter, a historically slow sales season.

Amazing conditions for sellers. Challenging for buyers.

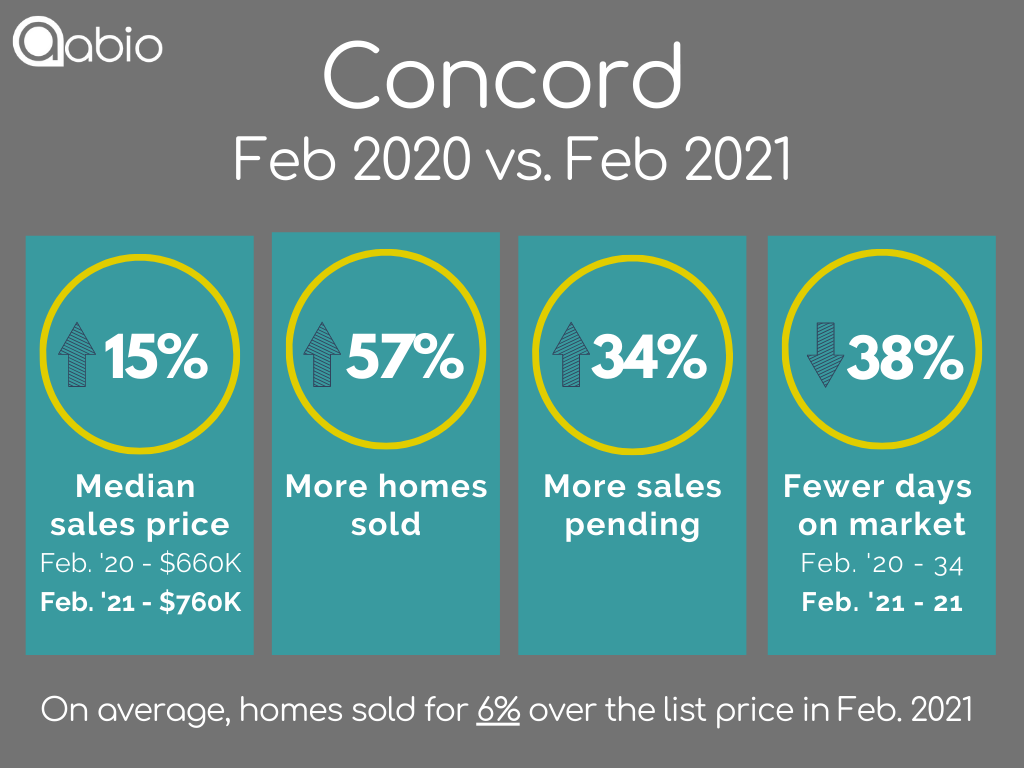

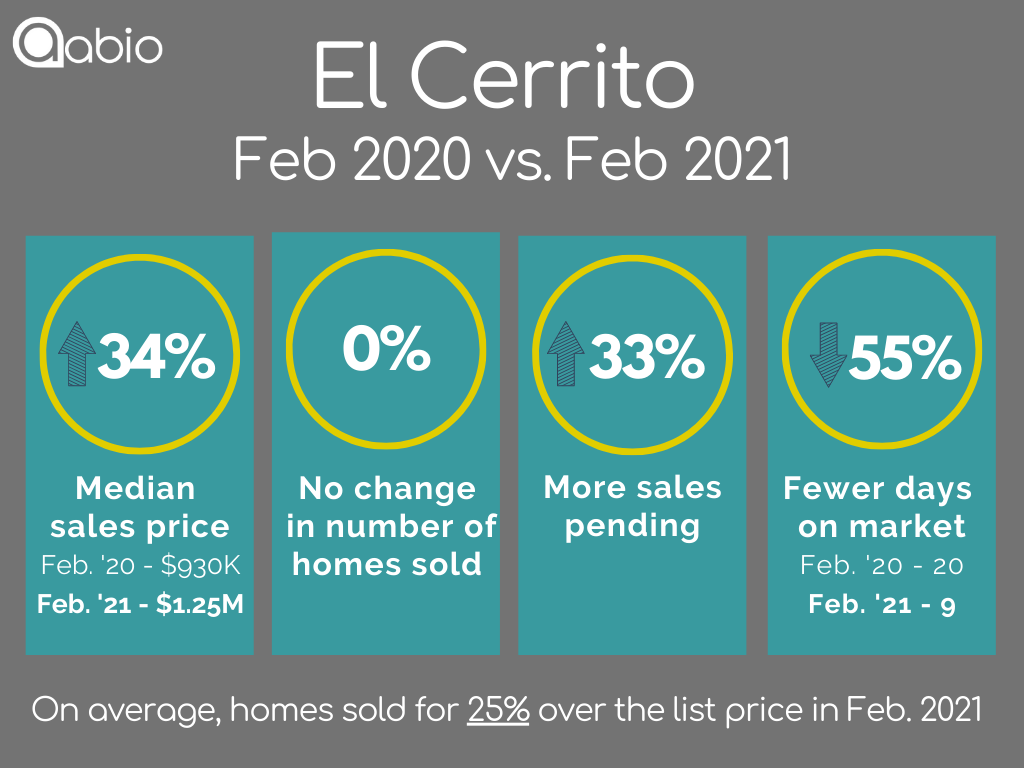

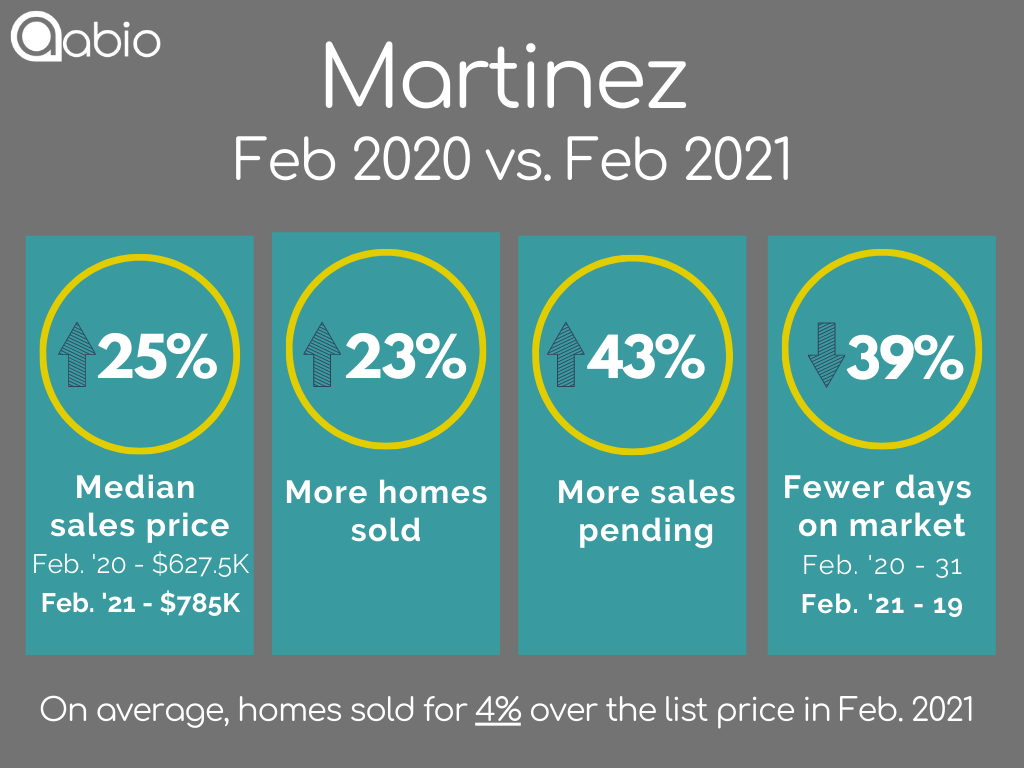

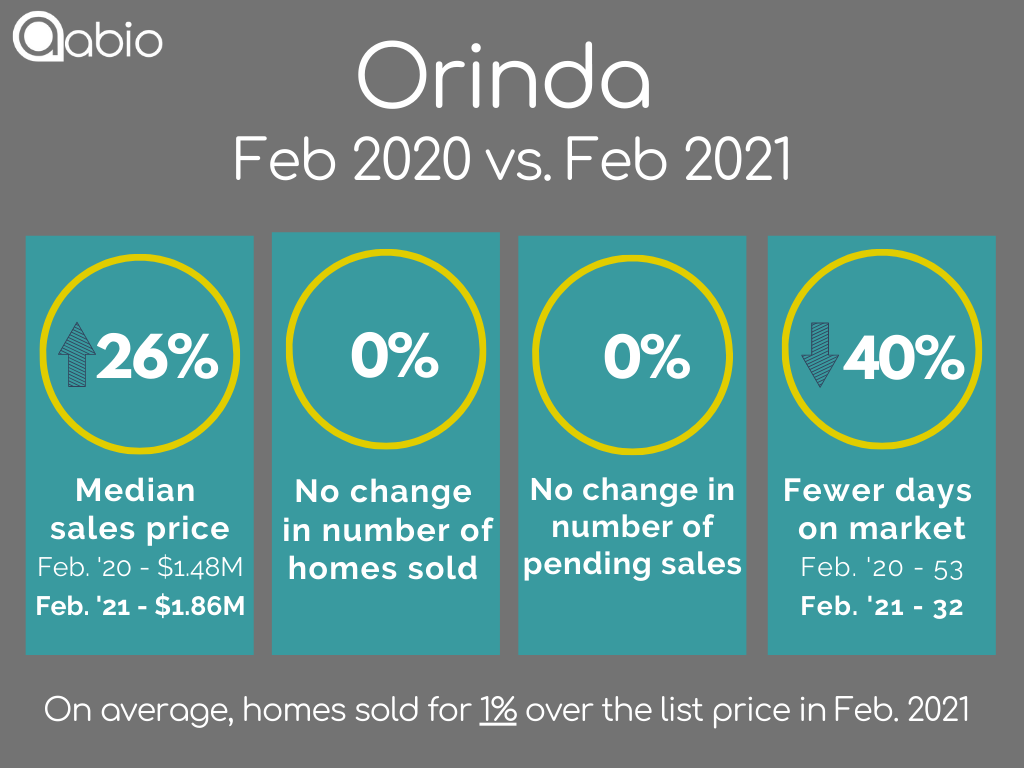

In February, median sales prices for single-family homes rose year-over-year in every East Bay city we track. Stand out statistics:

- Alamo saw median sales prices increase a jaw-dropping 37% – from $1.7 million in February 2020 to nearly $2.4 million in February 2021.

- El Cerrito’s median rose 34% – from $930,000 to $1.25 million.

- Berkeley and Oakland both saw 20% increases, with the median hitting $1.57 million and $930,000, respectively.

“It’s impossible now to get anything in Oakland for under $900,000,” says Abio Properties Realtor Rosie Papazian. “Even historically affordable neighborhoods for first-time buyers – Maxwell Park, Millsmont, Laurel, and Eastmont Hills – have all hit $1 million for a two-bed, one-bath house. And in Berkeley, it seems like every house my clients make an offer on sells for 30%-40% over the initial asking price.”

Don't believe those list prices

Of all the East Bay cites we track, only Alamo homes on average sold at the advertised price in February. Stand out statistics:

- El Cerrito houses sold for 25% over on average.

- Albany homes sold for 20% over.

- Berkeley homes sold 17% over.

Speaking of Berkeley, an 850-square-foot bungalow in the flats listed at $899,000 went into contract for over $1.3 million in February. And a 2,610-square-foot house in the Thousand Oaks neighborhood listed at $1,695,000 sold for $2,225,000.

Whoa! And...Why? Well, one factor is homes are being priced artificially low to attract interest. It obviously works.

40 offers on one house

An 805-square-foot Oakland home near Mills College that was listed for $575,000 attracted a whopping 40 offers in February. (The home is in escrow, so the final sales price isn’t public yet. But we’re sure it went for waaaaaay over asking.) Another home in the entry-level neighborhood pulled 20 offers.

"Bidding is crazy right now in Contra Costa County with a ton of non-contingent offers well above list price, just like in Alameda County," says Abio Properties Realtor Raquel Louie. "Twenty-two offers is the new normal. It’s crazy."

Power move: Preemptive offers

Some buyers find ways to beat the competition by offering sellers too-good-to-refuse preemptive offers – meaning they bid on a house before the seller's published date to hear all offers. All cash, no contingencies, free rent back, quick close.

It's a power move for the winning buyer. But “it sucks to be out there with a client who wants to see a house two days after it is listed on MLS only find out it is already pending sale,” Raquel says. "This happened to my clients who were shopping in Walnut Creek's Northgate and Woodlands neighborhoods."

If you are interested in a property for sale but worried you might be beat by a preemptive offer, know this: The seller's agent is required to alert other agents when they receive a preemptive offer. Make sure your agent is staying informed so you have a chance to compete.

If you are thinking about making a preemptive offer, know that some agents are willing to entertain early bids while others will decline, feeling ethically bound to honor the published date to hear all offers.

More inventory, pretty please

Interestingly, while the national housing inventory plummeted in January 2021 compared with January 2020, our region saw a surge of homes come on the market. Silicon Valley had a nearly 25% increase in homes for sale, and the San Francisco Bay Area (includes the East Bay) had a 14% increase, according to Realtor.com.

Why? Resident reshuffling. Many of our home sellers realize they can work remotely from anywhere now, so they are moving from the Bay Area to lower-cost regions and dream locales. They also recognize they might make a tidy profit in this market.

Heading into March and April, we are excited to see this inventory bump continue.

Spring strategies: How to buy a house in the Bay Area

Keeping with the theme of our teenagers' favorite dystopian fantasy novel, what's the best Hunger Games-esque strategy for buying a house in these market conditions? Should you run in with weapons (er, cash offers) blazing? Should you hunker down and wait for the perfect time to strike?

Well, we're not a violent or cheating bunch here at Abio Properties. We relate more to bread-baking Peeta and valiant Katniss than the story's more violent competitors. But we also aren't the types to hide in the bushes.

Here is what we advise would-be homebuyers:

"May the odds be ever in your favor." -from the Hunger Games, but an apt wish for today's homebuyers, too

1. Mindset: Practice the 3 Ps

Patience. Persistence. Positivity. With the help of your trusted real estate agent, you will find the home you are meant to be in.

2. Logistics: Be prepared

This market moves fast. Avoid the nerve-racking stress of hunting down your financial documents after you’ve seen the house of your dreams and want to make an offer. You will lose out to a more organized buyer who was ready to submit a fully qualified offer. Get all your docs in a row (See our list of what goes into your Green File), and get pre-approved for a mortgage loan.

3. Creativity: Think outside the box

Consider homes that might not have the exact number of bedrooms you want but have convertible spaces like bonus rooms or extra acreage to build an accessory dwelling unit. Be open to different neighborhoods in up-and-coming areas with fewer competitors. See our charts below; you might find a city not currently on your radar.

Let's all take a collective deep breath.

What’s happening in YOUR city?

The following data is for detached single-family homes. Sources: Bay East Assoc. of Realtors and Contra Costa Assoc. of Realtors. Compiled by Abio Associate Broker Diana Smith.

Alameda County

Contra Costa County

Don't be too shocked by the apparent 1,233% increase in the number of days that homes took to sell in Lafayette in February. A few outliers – houses in the $4 million to $9 million range – have sat on the market for months and thereby skewed the average. The median number of days on the market was closer to 6.

--

Don't see your city of interest here? Drop us a line and we'll get you what you need! 888-400-ABIO (2246) or [email protected].